Real Estate Finance Salary Survey 2022

Cobalt recently took a market pulse from our network to find out how remuneration and total benefits packages have been changing since the Covid-19 pandemic across finance and accounting.

With challenges to recruit the best staff becoming more difficult every month as the demand now far outstrips the supply, we wanted to make sure we had accurate information on the trends not just around salary, but the additional benefits they are being offered.

Finding out salaries, bonuses and sentiments in real estate finance

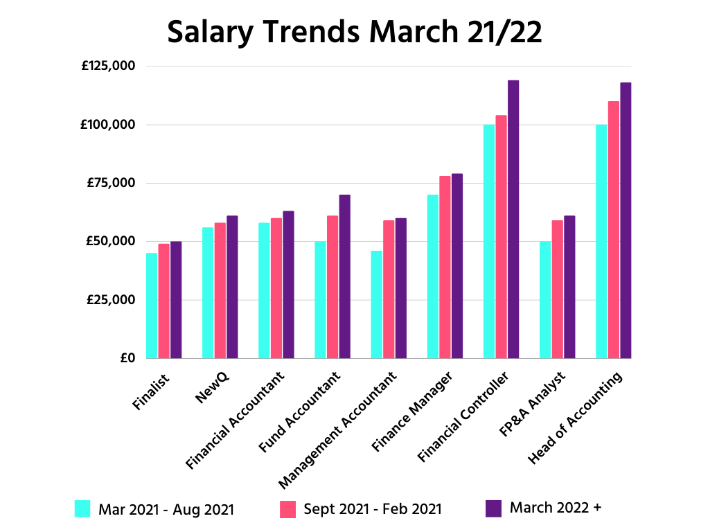

We asked questions about current salary and bonus, what they would expect for a move and the additional benefits they had received post-pandemic (not just a list of their “normal ones”). We also reviewed the roles we have worked on over a 12-month period and the salaries and bonuses secured when they were filled. The first trend we noticed was that the salary bandings clearly show a strong upward trend across all job roles reviewed.

This is not surprising given the much-publicised wage pressures across the UK economy as we moved out the pandemic - but perhaps the scale of the change was a surprise. Some fund accountants were seeing salary increases of up to 30% with financial and management accountants seeing 20% salary increases within the real estate sector.

Salaries, Bonuses and Benefits for Qualified Accountants

Salaries – All candidates who had completed the survey had a salary review either within the last 6 months or scheduled before the middle of the year. 90

% of candidates were in line with the market rates that we expected. The remaining 10% is an even split of above and below expectations.

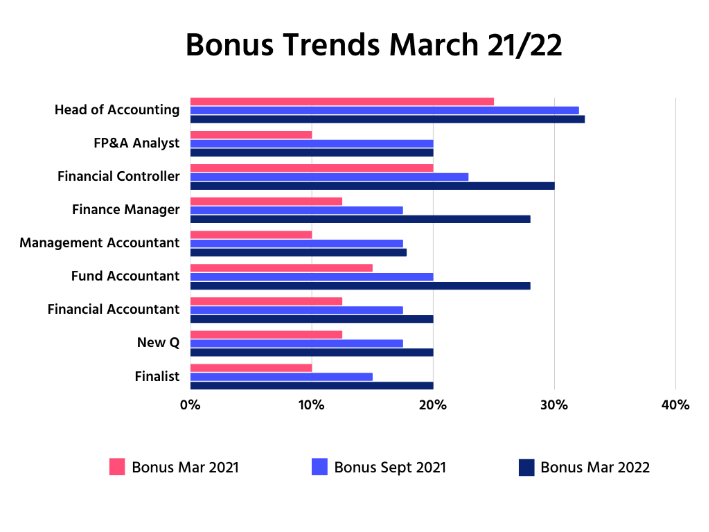

Bonuses – This is where we see the significant change – bonuses have taken a sharp increase across all levels of the role. 30/40% bonuses were once reserved for the most commercial or senior level roles, but 1-3 year PQEs are seeing higher bonuses in their most recent packages, and they are expecting the same again in the future. Finalists and FP&A Analysts have seen bonus potential double to 20% in the last year alone – and this is on top of the salary increases we have already commented on.

Benefits – Again, another significant change here with permanent hybrid working being one of the largest changes to people’s benefits. Also, LTIPs are now being offered to less senior individuals as well as retention bonuses. Additional days of holiday, company trips and social events also show that companies are looking to improve employee packages with better benefits rather than just financial incentives.

What was interesting was on top of these trends is that individuals who would not previously have negotiated or asked for certain flexibilities, promotions and rewards have now done so. Clearly, all the changes to the norm and talent short markets are empowering people to open discussions, but we are seeing that at the Newly Qualified (0-1 year PQE) that the recent increase in audit firm pay (between 5-10%) will have a knock effect to the market over the next 6 months increasing salaries.

Salaries, Bonuses and Benefits for Property Management Accounts and Part-Qualified

This section of the market from a salary and bonus level has remained consistent.

However one of the questions we asked was what they would expect their pay to be moving forward or for a move, and this is where we saw candidates looking for a less realistic 20-25% increase in base salaries if they were to move roles. Typically, we expect increases around 10% with 15% on rare exceptions.

Hybrid working, share scheme options and more holiday days and more attractive study support packages are being offered to individuals to improve their benefits and bonuses seem steady between 5-15%.

It is notable however that at these levels people are being paid wage levels accurate for their current role, so especially within the Property Management Accounts market this means that candidates are more focused on moving for a pay rise or maintaining or improving their already good benefits package.

Summary

Companies have worked hard to retain their staff over the last 18 months, so individuals are paid accurately for the role they are doing, have strong bonuses with prospects of further good ones and are getting better benefits than they were 2 years ago.

This exacerbates the talent shortage as whilst lots of candidates are passively looking (45% average from the surveys), they expect a lot from a new potential employer if they are going to consider a move.

The information also states that 22% of candidates are actively looking, but we feel this number is slightly skewed as the most likely responders to our survey will be job seekers, and is not a reflection of the ratios that we see from our consultants’ data which is more like 10-12%.

What this means for hiring is that it will take longer to find the ideal candidate, unless employers are happy to pay above market rate, larger bonuses or offer more flexibility and other “perks”. We are consulting with clients to look at alternative hiring strategies - taking on less experienced individuals and upskilling them in a role, looking at those from other markets and interim solutions are often the best way to bring in people on budget and within reasonable timeframes.